home buying interest rates today

Higher interest rates today mean that fewer buyers are looking to buy. For example in a 2-1 buydown scenario the buyers interest rate will be 2 below the contract rate during the first year.

Mortgage Rates For Jan 7 The Washington Post

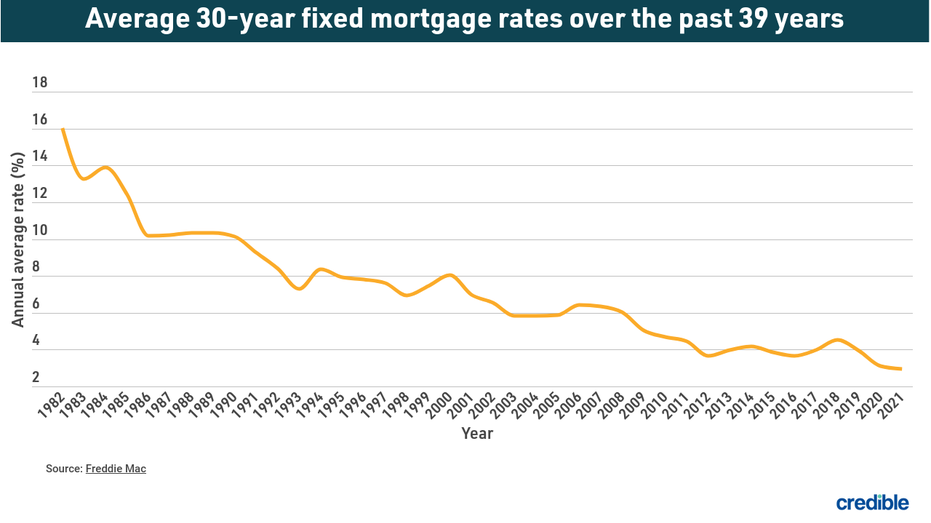

The Federal Reserve recently raised interest rates by another 075 percentage points in an attempt to curb record-high inflation.

. 2 days agoMortgage rates currently are. On Tuesday November 8th 2022 the average APR on a 30-year fixed-rate mortgage fell 3 basis. The cost of a point depends on the value of the borrowed money but its generally 1 percent of the total amount borrowed to buy the home.

And the average rose. The average mortgage interest rates decreased for all loan types week over week 30-year fixed rates went down 708 to 695 as did 15-year fixed rates 636 to 629 and 51 ARM. 5 rows Getty.

As of 2022 Congress set the conforming loan limit for single unit homes across the continental United States to 647200 with a ceiling of 150 that amount in areas where median home. NerdWallets daily mortgage rates are an average of the published annual percentage rate with the lowest points from a sampling of major national lenders. 19 rows If youre purchasing a home located in a federally Targeted Area of the.

In the second year it changes to 1 below. If its lower than that you should hold off and see if interest rates will go down. The average interest rate jumped by more than half a percentage point since March 10 per Freddie Macs weekly Primary Mortgage Market Survey.

At 394 the monthly cost for a 200000 home loan was 948. If possible check with your lender to see if. The Fed has raised rates a total of six times.

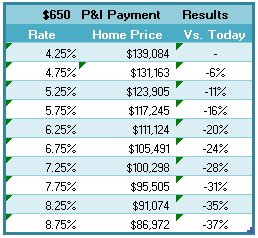

Advantages of Selling Your Home When Interest Rates Are High. If mortgage rates are around 550 and your mortgage is above 625 refinance is a good idea. While rising interest rates continue to take out buyers who can no longer afford the higher monthly payments something else is.

Buying points upfront can help you. 5 rows Mortgage Interest Rates Forecast 2022. The current rate of 7 percent has added.

Home Rates Today In California Oct 2022. The average mortgage rate went from 454 in 2018 to 394 in 2019. Thats because mortgage rates are generally tiered and typically lower rates are available for those with a down payment of 20 or more.

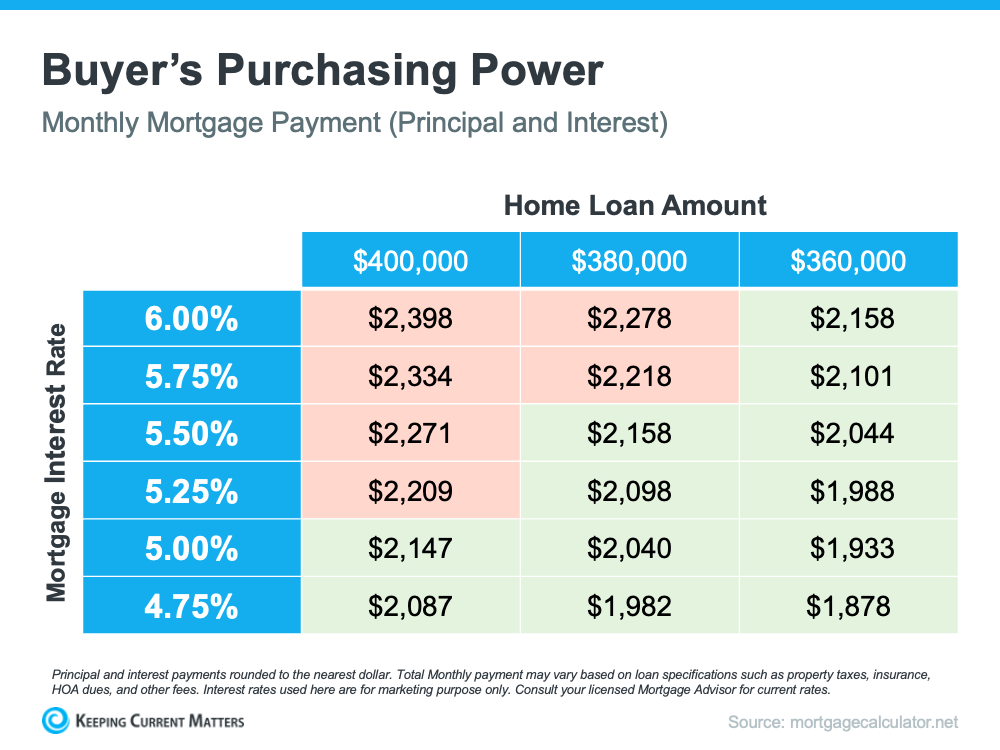

If todays interest rate is 325 heres how your home buying budget might look. Todays average 30-year fixed mortgage rate is 691 The average 20-year fixed-rate mortgage currently sits at 669 Todays 15-year fixed. In fact rates dropped in 2019.

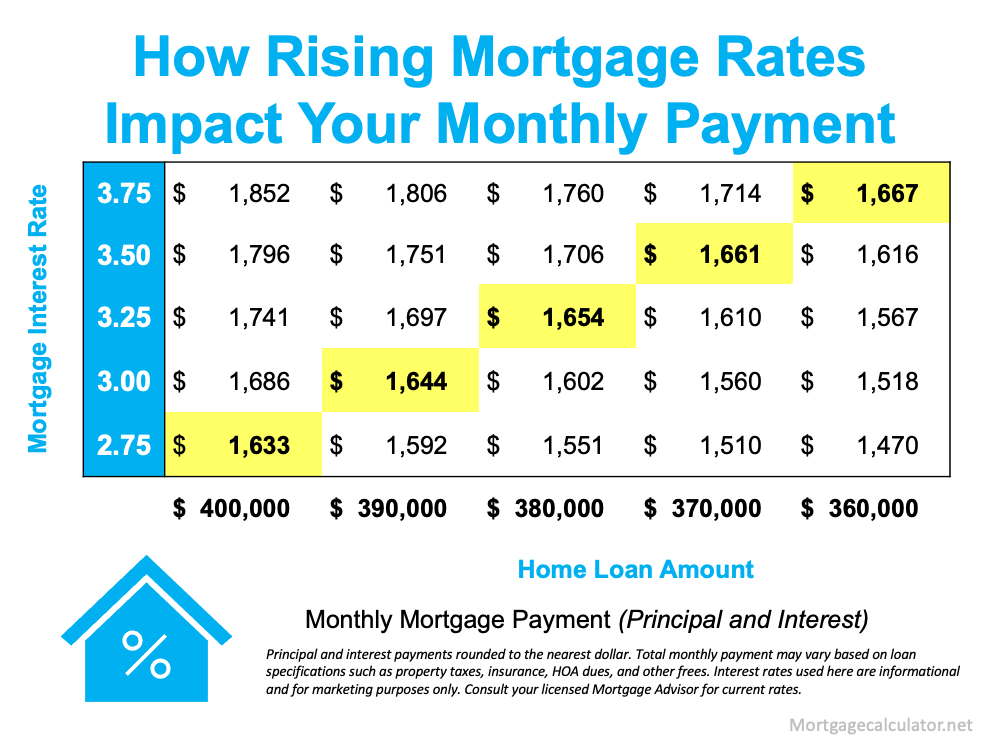

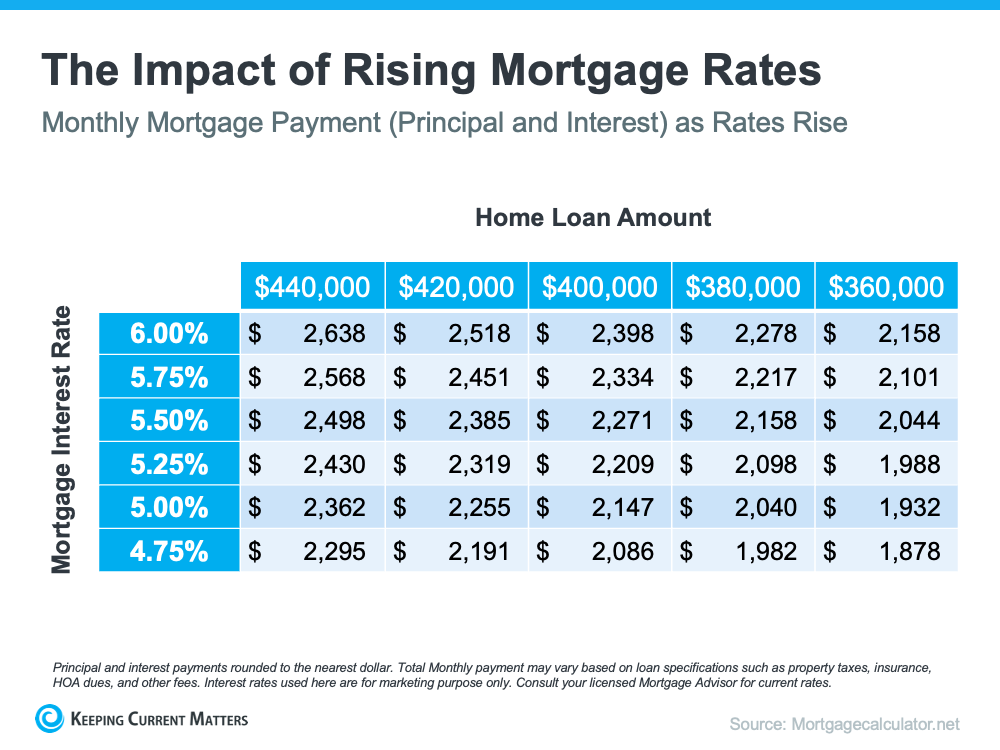

20 100000 Monthly principal and interest payment. Experts are forecasting that the 30-year fixed-mortgage. Since the beginning of the year the interest rate on a 30-year mortgage loan has climbed from about 3 to nearly 7 making it much more expensive to buy a house.

On Friday November 11 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed mortgage rate is 6910 with an APR of. More Home Choices Available. According to the National Association of Home Builders and their counterparts in the Mortgage Bankers Association the estimated interest rate for an average 30-year fixed period is about.

No matter when you decide to shop for a home its always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific. Home Rates Today In California - If you are looking for a way to reduce your expenses then our trusted service is just right for you.

Mortgage Rates Rise To Highest Point In 13 Years After Federal Reserve Rate Hike Eating Away Homebuying Power Cleveland Com

How Today S Mortgage Rates Impact Your Home Purchase Keeping Current Matters

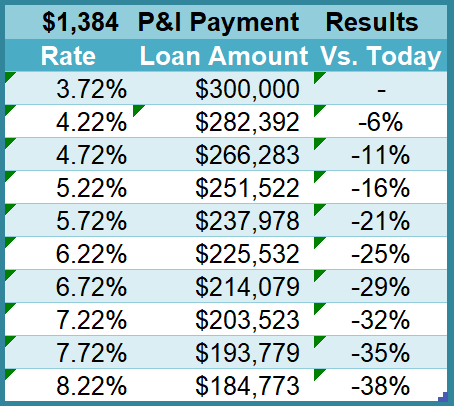

Are You Waiting For Buying Home Check How The Rising Mortgage Rate Will Affect Your Monthly Payment Har Com

How The Federal Reserve Affects Mortgage Rates Discover

How Today S Mortgage Rates Impact Your Home Purchase Centre Realty Group

Today S Mortgage Rates April 30 2021 Rates Are Mixed

Will Mortgage Rates Go Down Realty Austin

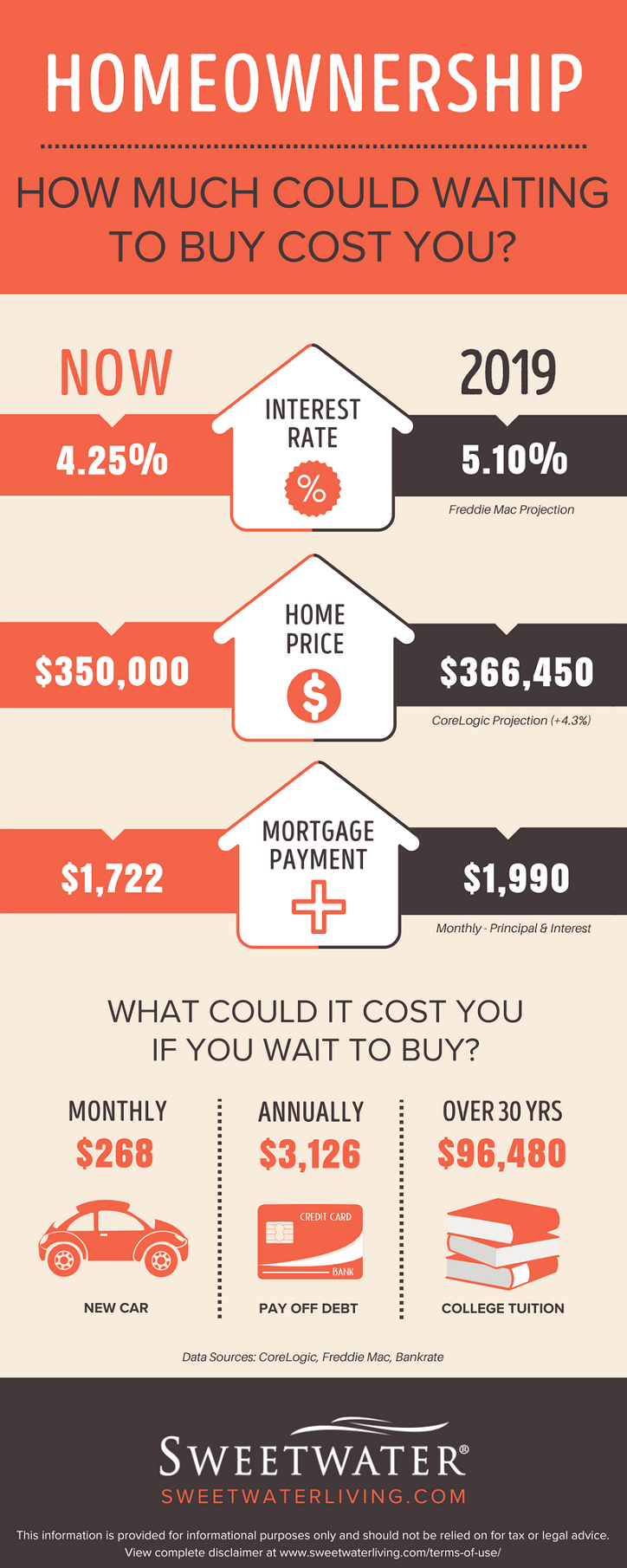

As Interest Rates Rise What Will It Cost To Wait To Buy A New Home

Mortgage Interest Rates Fall Home Affordability Rises

How To Approach Rising Mortgage Rates As A Buyer Keeping Current Matters

1 Difference In Mortgage Rate Matter Moneyunder30

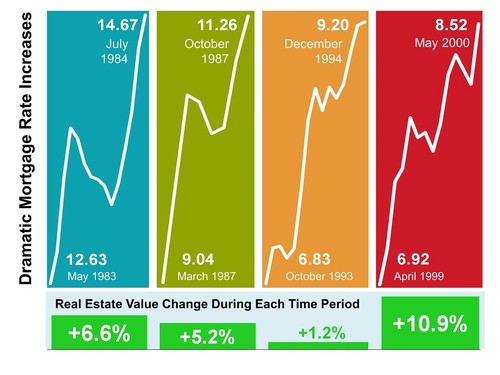

Rising Mortgage Interest Rates The Romanski Group

Mortgage Catch 22 Interest Rates Are Lower Than Ever But Millions Of Borrowers Can T Get A Loan

Mortgage Interest Rates 20 Lower Tallahassee Home Loan

Mortgage Rates Impact Purchase Power

Today S 20 Year Mortgage Rates Fall To 36 Day Low Nov 10 2022 Fox Business

/cloudfront-us-east-1.images.arcpublishing.com/pmn/CVO5AZL6LZATFNAXXDDFAKM4S4.jpg)

Home Buyers This Summer Saw Mortgage Rates Swing Up And Down More Than At Any Time Since 1987

The Impact Of Interest Rates On Home Ownership A Primer Opendoor